European solar, eclipsed?

The fate of Europe’s solar industry has implications for the EU industrial base—and its economic security

Welcome to a/symmetric, published by Force Distance Times. Each week, we bring you news and analysis on the global industrial contest, where production is power and competition is (often) asymmetric. To receive issues over email, subscribe here.

This week:

Europe’s solar industry is warning of its own imminent collapse. At stake isn’t just solar dependence on China, but whether Europe can safeguard its industrial base and strengthen economic security.

Weekly Links Round-Up: OpenAI wants to go upstream, the US wants to ramp up munitions production, and capital flows are at the heart of geopolitical competition.

European solar, eclipsed?

This week brings news of Europe’s solar panel manufacturers verging on collapse amid a wave of cheap Chinese imports.

The EU does not appear to be in a hurry to rescue its solar industry. A senior EU official said any moves to curb Chinese solar imports have to be weight against energy transition objectives.

Some frustrated EU lawmakers are echoing industry’s call for swift emergency actions to save the sector. While the European Commission dithers on policy responses, Irish MEP Ciarán Cuffe cuts to the chase: “Will this solar revolution be red or fully green?”

It’s an excellent question. At stake isn’t just the matter of Europe swapping its Russian fossil fuel reliance for solar dependency on China. Also hanging in the balance is whether the EU can sustain a robust industrial base on which its economic security depends.

“Staggeringly wasteful but…stunning results”

Let’s briefly recap China’s rise to global solar manufacturing dominance. (Skip to the next section if you don’t need this rehashed.)

The US invented silicon solar cells in the 1950s and pioneered their use on spacecraft. For a while, American producers dominated solar panel manufacturing. By the 1980s, production had shifted elsewhere, including Japan and Germany.

Skip forward: in 2009, China rolled out state subsidies for solar installation projects, followed by subsidies for solar-generated power from 2013. Five years later, Beijing slashed subsidies. Weak firms perished; the fittest survived. By then, a dense network of suppliers spanning solar’s upstream and downstream had matured, helping manufacturers to scale production, reduce costs, and gobble up global market share.

Gavekal’s Yanmei Xie sumarizes this playbook succinctly in the Financial Times this week:

“China’s well-rehearsed industrial policy can be staggeringly wasteful but still produce stunning results. This same pattern of fattening up companies with subsidies and protection and then cutting support and introducing market discipline to weed out the weak has already produced domestic and export juggernauts in steel, shipbuilding and solar panels.”

Now, China’s solar strategy is turning to focus on internationalization: not only exporting solar panels, but also setting up factories abroad1

If European solar manufacturers were to go belly up en masse, one can imagine Chinese competitors swooping in to snap up their factories for fire sale prices.

The high industrial stakes of European solar

Losing the European solar industry would also deal a blow to the EU’s efforts to strengthen its industrial base and bolster economic security.

First, developing and maintaining a solar sector has spillover effects for a country’s manufacturing capacities.

Consider, for example, the fact that China’s LCD TV and solar panel industries took off around the same time, thanks to similarities in their manufacturing processes. At the time, Tianjin Zhonghuan, which made silicon components for bulky CRT TVs, was about to go obsolete as LCD screens took over. Thanks to the rise of the solar sector, Tianjin Zhonghuan had only to tweak its manufacturing set up to make silicon and wafers for solar panels2 TCL Zhonghuan, as the company is now called, has since become a leading global producer of silicon wafers.

Bottom line: a solar manufacturing industry helps sustain a network of suppliers that form the building blocks of a strong industrial base.

Second, innovation comes from the factory floor—which in turn spurs more production.

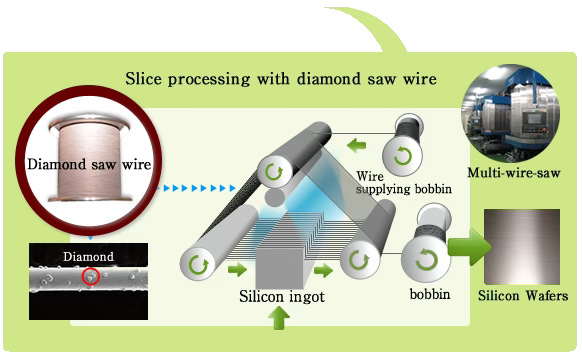

Chinese solar panel giant LONGi presents a good example of this. Its diamond wire cutting technology, which slices silicon ingots into wafers, is faster, cheaper, more efficient than the older slurry cutting method. While diamond wire cutting technology originated in the US and Japan, the rise of China’s solar industry helped pull the domestic diamond cutting sector along.

Yangling Metron, a diamond wire producer founded in 2015, more than doubled its global market share from 20% in 2017 to 50% by 2021—in large part thanks to soaring demand from major customers including LONGi and other domestic solar manufacturers. While China used to rely on diamond wire cutting machines from the US and Japan, it has now largely replaced those imports with domestic supplies.

The takeaway: a solar industry presents opportunities for adjacent sectors to innovate, take shape, and win market share worldwide. In that sense, the damage from letting Europe’s solar industry go to ruin would go far beyond losing the ability to make solar panels locally.

Weekly Links Round-Up

🖇️ OpenAI goes upstream. CEO Sam Altman wants to raise as much as $7 trillion to fund the production of AI chips. Will he be able to pull off this ambitious vertical integration strategy? (WSJ)

🖇️ Capital flows and geopolitical competition. Beijing-headquartered IDG Capital Partners is the first private equity and venture capital investment firm to make the Pentagon’s list of entities deemed “Chinese military companies” operating in the US. Meanwhile, the House Select Committee on China says US funds have invested billions in companies tied to the Chinese military and advance Beijing’s strategic aims. Finance, as much as critical resources and cutting edge tech, is a key domain of great power competition. (Nikkei Asia, Reuters)

🖇️ The US Army aims to double 155mm shell production this year. Domestic output of the key munition used in Ukraine hit 28,000 in October 2023, and is projected to rise to 60,000 by October 2024 and 100,000 by October 2025. To enable that production, the Army’s acquisition chief wants to procure a lot more explosives, both from allies and domestically produced. (Defense One, Defense News)

Related: check out our post from last month on military explosives.

A researcher at a state-owned think tank wrote recently that Chinese solar firms should “take advantage of the global energy crisis and countries’ efforts to localize the photovoltaic industry chain to…invest and build factories in the European, American, Middle Eastern and Latin American markets… integrate into the overseas photovoltaic manufacturing industry chain and continue to maintain the global leading advantage of China's photovoltaic industry.”

This example is drawn from Lin Xueping’s new book, “Supply Chain Attack and Defense,” published in December 2023. Regular readers may remember Lin, who we cited extensively in our recent piece on machine tools and ballpoint pens. We will dive into Lin’s book in an upcoming issue of this newsletter.