Why China still can’t make ballpoint pens

And what that means for its high-end machine tools ambitions

Welcome to a/symmetric, published by Force Distance Times. Each week, we bring you news and analysis on the global industrial contest, where production is power and competition is (often) asymmetric.

This week:

Made-in-China ballpoint pens and advanced machine tools may face similar problems that top-down industrial policy may be hard-pressed to tackle

Weekly Links Round-Up: Europe’s economic security, delays and overruns at a previously China-backed UK nuclear power plant, and the British businessman who vanished in China.

Why China still can’t make ballpoint pens

There is what’s regarded in China as a “classic” question of manufacturing:

Why can’t China make a ballpoint pen? (Yes, that quotidian piece of stationery for scribbling and doodling with.)

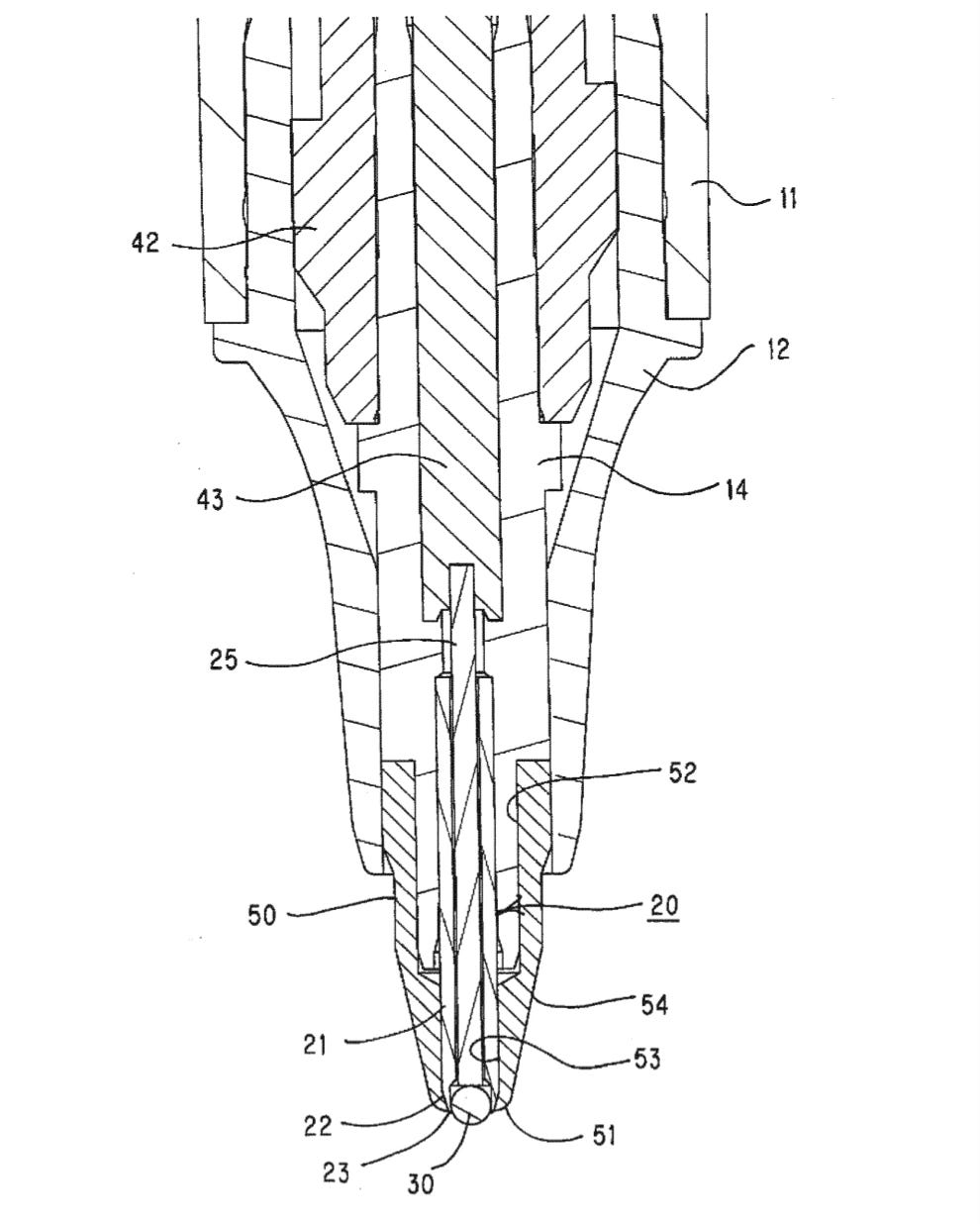

As it turns out, the ballpoint of the ballpoint pen—a tiny metal ball bearing that “mimics the action of roll-on deodorant,” rotating freely in a small socket to dispense a smooth stream of ink—is fiendishly difficult to make, requiring super precise machinery and high-quality steel made to very specific standards.

While China claimed a breakthrough in 2017, manufacturing a ballpoint pen all by itself and “ending a long-term reliance on imported [ballpoint pen tips],” as of 2021 the country was still reportedly 80% dependent on imported ballpoints.

In fact, Chinese imports of ballpoints pens (comprising the ballpoint and ink reservoir) have more than doubled since 2017, from 12 million USD to nearly 28 million USD last year.

As Lin Xueping, an expert on manufacturing technology, wrote in an article last year, it was one thing for a single Chinese company to make a technical breakthrough, and another to get the rest of the market to adopt it.

“Taiyuan Iron & Steel finally decided to overcome the difficulties and finally made steel ball materials,” Lin wrote, referring to the Chinese steelmaker that made the pen tip breakthrough. “But domestic ballpoint pen manufacturers are unwilling to use it at all.”

There’s a larger point to all of this: China’s struggles with the ballpoint run in tandem with its efforts to make high-end machine tools.

Machine tools: a technical challenge or an economic one?

Machine tools are machines that make other machines. China is a leading producer of machine tools, accounting for about 31% the world’s output in 2021 (p.10, fig. 12)—ahead of Germany (13%), Japan (12%), the US (9%), and Italy (8%). But China is heavily reliant on foreign technology for high-end machine tools: in 2021, it was 91% dependent on foreign firms for the most advanced machine tools.

That’s in spite of a national-level initiative, dubbed “Special Project 04,” launched in 2009 to boost China’s capabilities in high-end machine tools. But still China has not quite cracked it.

Perhaps the problem is less technical and more economic. That’s the assessment from Lin, the manufacturing expert who’s also affiliated with a think tank run by the Ministry of Industry and Information Technology.

Top-notch machine tool beds, Lin reckons, demand very specific kinds of cast iron, with strict requirements for things like smelting method, casting temperature, and presence of trace elements. The problem is that demand from Chinese machine tool makers for this kind of cast iron is too small to make economic sense for iron foundries to work on developing the specialized materials.

“Made in China has two weaknesses: one is ‘can't be made,’ which is a real technical chokehold; the other is ‘can't be used,’ which is often stuck on non-technical barriers,” Lin wrote. “Ballpoint pens and cast-iron machine beds—both have stumbled for this reason.”

Implications for industrial policy

What lessons can we draw from China’s ballpoint pen travails?

Perhaps one is that just as the free market alone can’t solve certain problems, industrial policy may be more suited for tackling certain challenges than others.

In the case of China, it seems that its brand of top-down industrial policy has worked well for electric vehicles, batteries, critical minerals, shipbuilding, high-speed rail, and solar panels—but less so for semiconductors, machine tools, and ballpoint bens.

One hypothesis is that the latter group of technologies requires a far more complex coordination of the industrial ecosystem. As such, the sheer force of the state’s will is more likely to run up against the fundamentals of market economics.

The upshot, for the US and the west, is not to parrot Chinese industrial policy, but to play to existing strengths. That means using government intervention to shape incentives, trigger certain behavior, and target market failures and distortions—but then stepping back to let the market solve for things.

Weekly Links Round-Up

🖇️ The EU aims to bolster its economic security. Building on an economic security strategy rolled out last June, Brussels this week unveiled a package of proposals to protect critical technologies and better regulate and monitor inbound and outbound investments. Just don’t expect those ideas to turn into action anytime soon. The outbound investment screening proposal, for example, will first see a three-month public consultation and a 12-month monitoring period—and that’s before the European Commission comes up with possible policy responses in autumn 2025. In the meantime, perhaps Europe could take some economic security lessons from Japan? (Force Distance Times, European Commission, The Economist)

🖇️ The UK’s ill-fated nuclear plant. Speaking of economic security: Britain is still dealing with the mess stemming from its 2015 decision to collaborate with the state-owned China General Nuclear (CGN) on three nuclear projects. In 2022, UK government paid CGN £100 million to exit one of the projects. Another project, the Hinkley Point C nuclear plant, now faces a new multi-year delay and billions in cost overruns—adding to financial problems after CGN in December refused to continue making payments. (FT, Guardian)

🖇️ The British businessman who vanished in China. A startling, though not altogether surprising, story: Ian J. Stones had worked in China for decades. In a case that has not previously been publicly disclosed, Stones was detained by Chinese authorities in 2018—and continues to be held in detention with sporadic consular access. He is currently serving a five-year sentence for allegedly illegally selling intelligence to overseas parties, a crime he was convicted of in a closed-door trial. Bottom line: the risks of operating in China grow ever larger, and harder to gauge. (WSJ)

You must be living in past🤣🤣🤣

What a bunch of BS. Try visiting China to finf the truth, then again the truth was never yoir intent🤣🤣🤣