Europe's Chinese guncotton dependence

China is busy selling the key gunpowder ingredient to both the EU and Russia

Welcome to a/symmetric, published by Force Distance Times. Each week, we bring you news and analysis on the global industrial contest, where production is power and competition is (often) asymmetric. To receive issues over email, subscribe here.

This week:

Europe needs China’s guncotton: Its dependence on Chinese imports of the key input for making gunpowder has more than doubled since 2021.

Weekly Links Round-Up: France boosts production of radar systems, US drone manufacturing’s growing pains, and Japan’s hot AI computing real estate market.

Europe needs China’s guncotton

The defense industrial base is many things: basic components like chips; raw materials like steel and specialty metals; research on dual-use technologies and cutting-edge defense capabilities.

Right now, Europe is discovering a key vulnerability in that industrial base—namely, its dependence on China for a key military upstream input, guncotton.

“There is a huge undersupply of [nitrocellulose], which is causing difficulties elsewhere within the industry,” one defense industry executive tells the Financial Times.

That’s threatening the EU’s ability to ramp up arms production to supply Ukraine. It also raises uncomfortable questions about European security and combat readiness if a wider, high-intensity war were to break out on the continent.

Guncotton, also known as nitrocellulose, is used to make gunpowder, propellants, and explosives. “You can’t fight a war without nitrocellulose,” national security expert Daniel Goure has aptly noted.

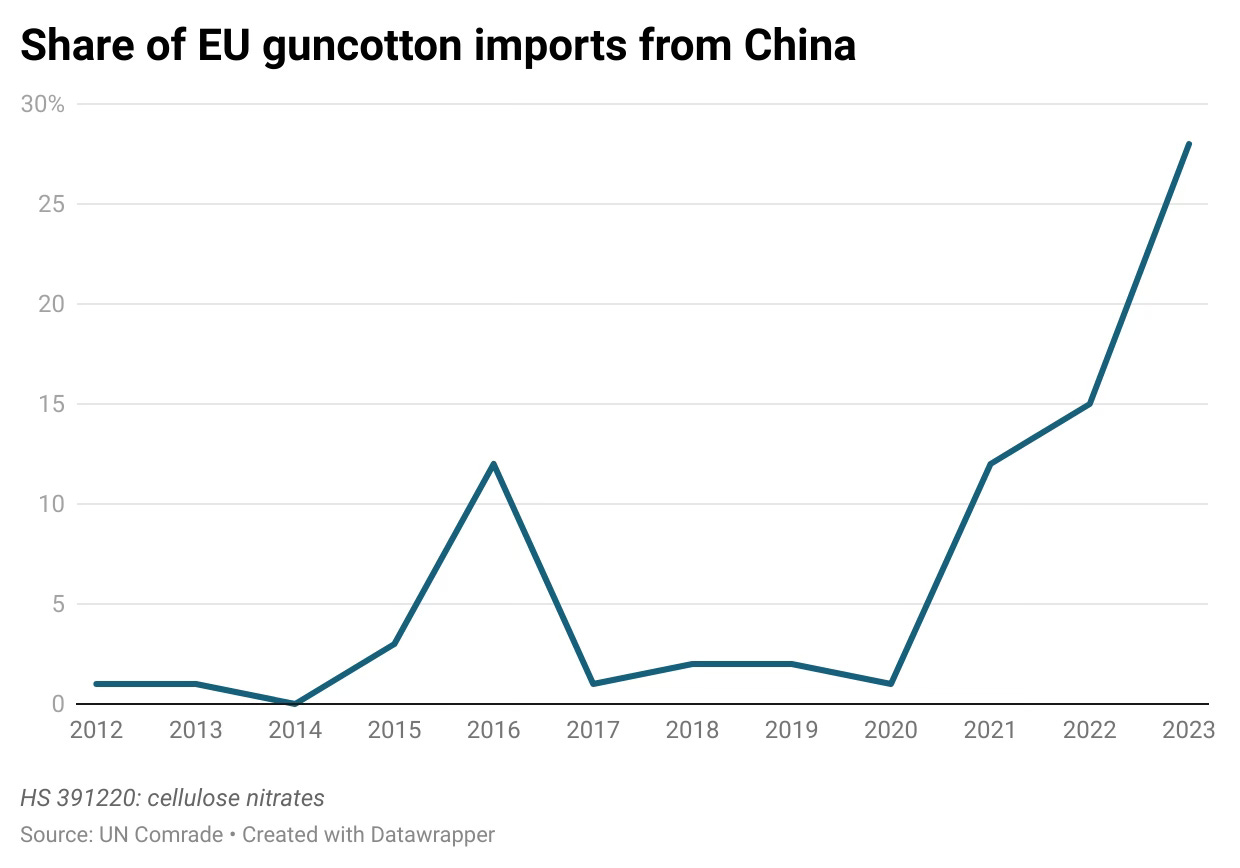

Even as Europe works to de-risk from China, trade data indicates that it is increasingly dependent on Chinese imports of guncotton. According to UN Comtrade, the EU relied on China for nearly one-third of its guncotton imports last year, up from 12% in 2021. And the bloc depends on China for over 70% of cotton linters, which are used to make gun cotton, Rheinmetall’s CEO told the FT.

…and China is doing brisk guncotton business

One of the top producers of guncotton in China is North Chemical Industries, previously known as Sichuan Nitrocell. It is part of China North Industries Group, or Norinco, the state-owned weapons giant that has been blacklisted for its role in supporting the Chinese military-industrial complex.

North Chemical Industries currently commands “over 20%” of global market share for nitrocellulose.1 And that’s not its only form of leverage over the global industry for the critical raw material: North Chemical Industries is on the executive committee of the Zurich-based Worldwide Nitrocellulose Producers Association.

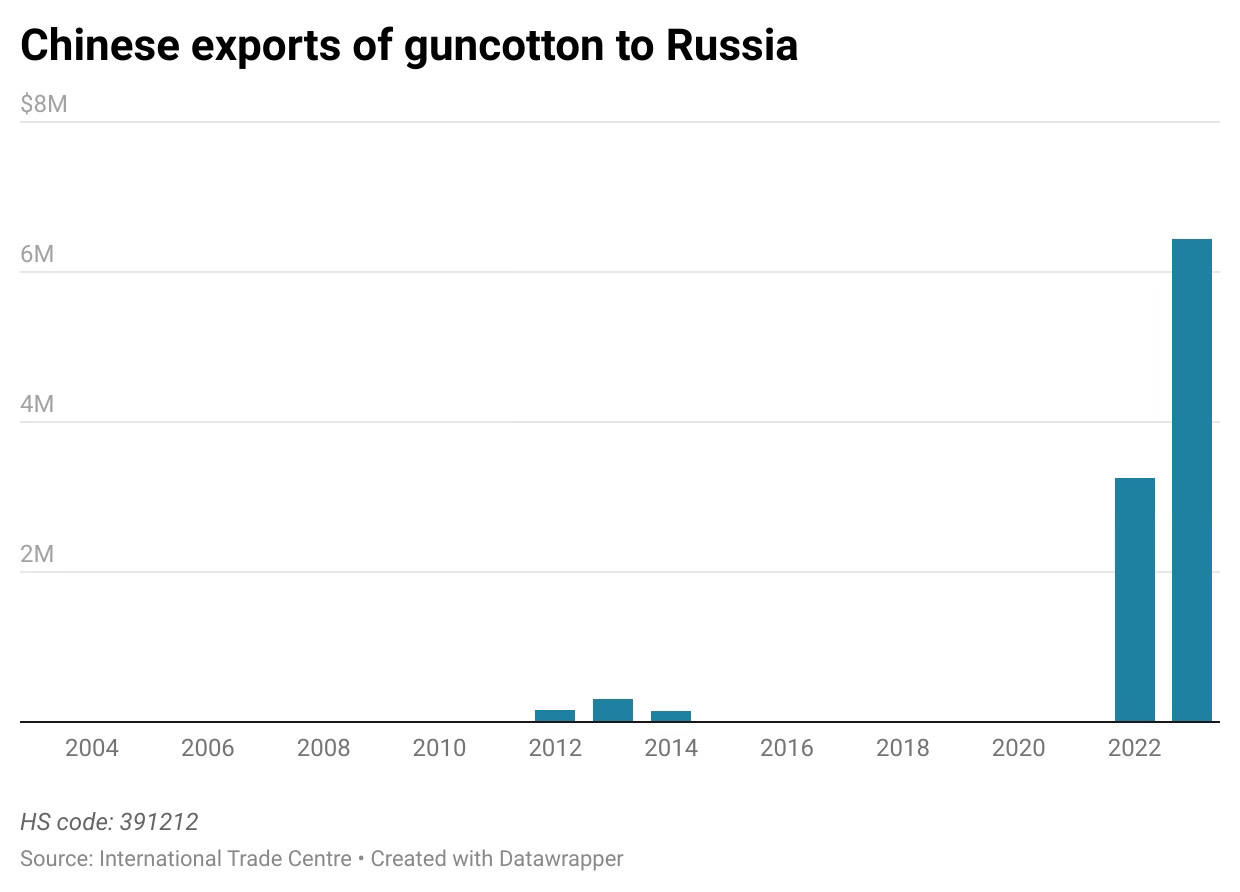

In the meantime, China is also doing brisk guncotton business with Russia. Trade data shows that China exported no guncotton at all to Russia from 2015 to 2021. In 2022, the year Russia invaded Ukraine, Chinese exports of guncotton to Russia jumped to $3.25 million. In 2023, that figure nearly doubled, hitting $6.45 million. That suits Russia just fine: Moscow is keen to get its hands on all the nitrocellulose it can to power its wartime production..

For more on defense industrial bases, read some of our recent coverage:

Weekly Links Round-Up

🖇️ Made-in-America drones stumble. “Most small drones from US startups have failed to perform in combat [in Ukraine], dashing companies’ hopes that a badge of being battle-tested would bring the startups sales and attention,” write Heather Somerville and Brett Forrest. Meanwhile, “China’s DJI has proven to be the go-to drone brand for Ukraine’s military.”

A core problem, it seems, is that US companies have struggled to take ideas from the drawing board and turn them into reality on the factory floor. As the CEO of California-based Skydio puts it, “The concept is cool and exciting. The actual delivery of working product has turned out to be phenomenally complicated.” (WSJ, WashPost)

🖇️ France ramps up production of air surveillance radars. “As European governments get serious about making their militaries war-ready, and Ukraine fights a life-and-death struggle against Russia, air surveillance radars are a must-have,” writes Laura Kayali. The challenge is how to boost output: Thales, the developer of the radar system, has had to revamp its production line to double production 10 radars a year to over 20. (Politico)

🖇️ Hot computing real estate. Singapore’s real estate investment trusts are piling into Japan’s data centers, hoping to increase exposure to AI computing infrastructure. That market is clearly heating up: Microsoft said this week that it’s pumping $2.9 billion into expanding cloud and AI infrastructure in Japan. (Nikkei Asia, Telecoms)

2022 annual report (p.18)