How China’s crane champions conquer global markets

Will Beijing run laps around Washington's attempts to root out China-built cargo cranes from US ports?

Welcome to a/symmetric, published by Force Distance Times. Each week, we bring you news and analysis on the global industrial contest, where production is power and competition is (often) asymmetric.

This week:

How China’s crane champions conquer global markets: US efforts to shore up critical infrastructure security as it relates to cranes must contend with the full roster of Chinese crane champions.

Weekly Links Round-Up: Germany questions its separation of civilian and military research. South Korea wants K-pop, K-dramas, and K-defense. The west’s opportunity to stockpile minerals. Plus: does the CHIPS Act reach far enough upstream?

How China’s crane champions conquer global markets

Will Beijing run laps around Washington's attempts to expel the “Trojan horse” of China-built cargo cranes from US ports?

Without a full view of major Chinese crane manufacturers, their competitive positions, and and how Beijing supports them to corner markets worldwide, that stands to be a real risk.

A quick recap. The White House is moving to strengthen defenses of US ports against cybersecurity threats posed by China-built cranes, which officials say contain sensors and software that could allow Beijing to surveil and subvert American supply chains—including those for military logistics. In tandem, the US will invest over $20 billion to boost domestic manufacturing of cranes.

Of particular concern to Washington is Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC), a state-owned manufacturer of ship-to-shore cargo cranes. The Wall Street Journal has reported that ZPMC accounts for nearly 80% of cargo cranes at US ports.

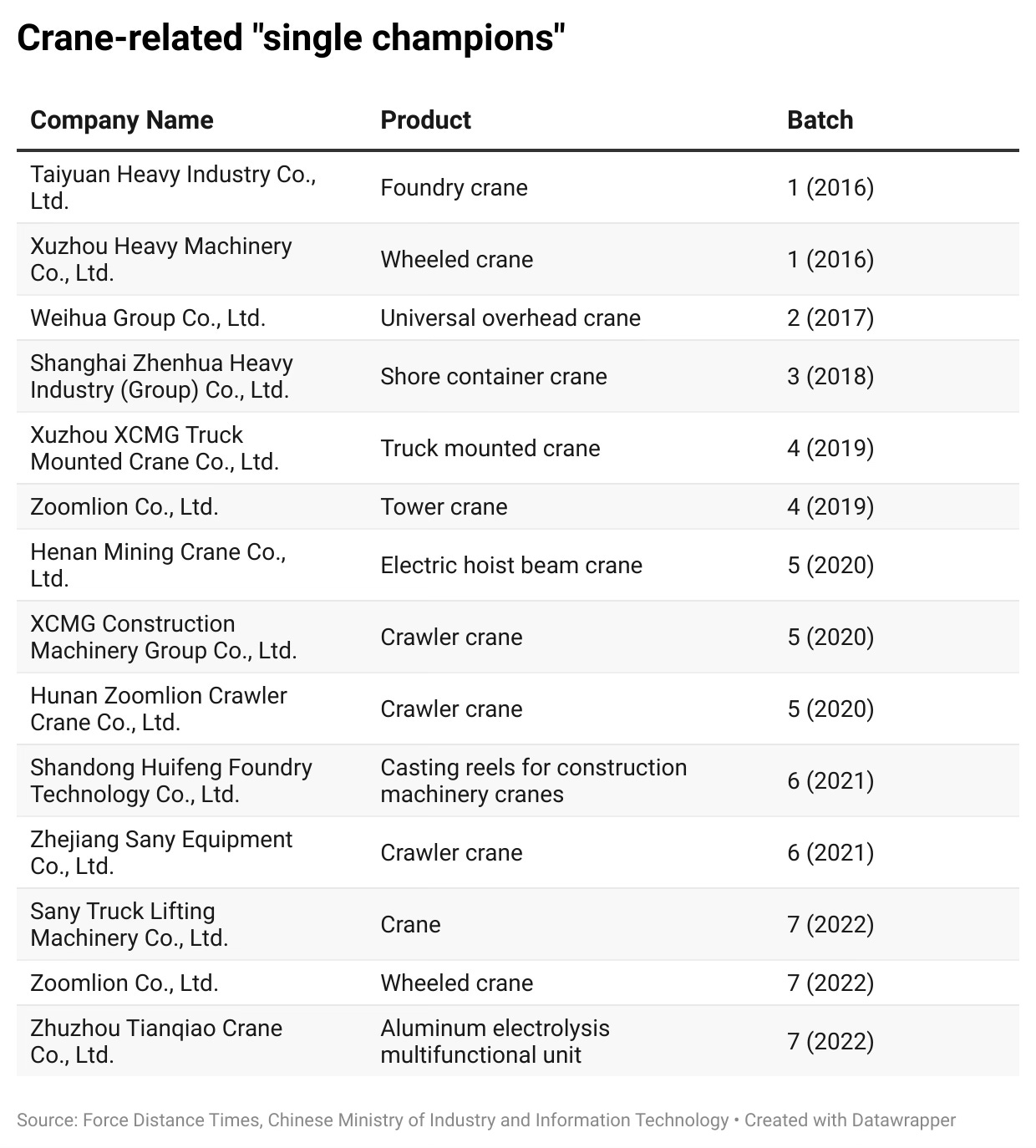

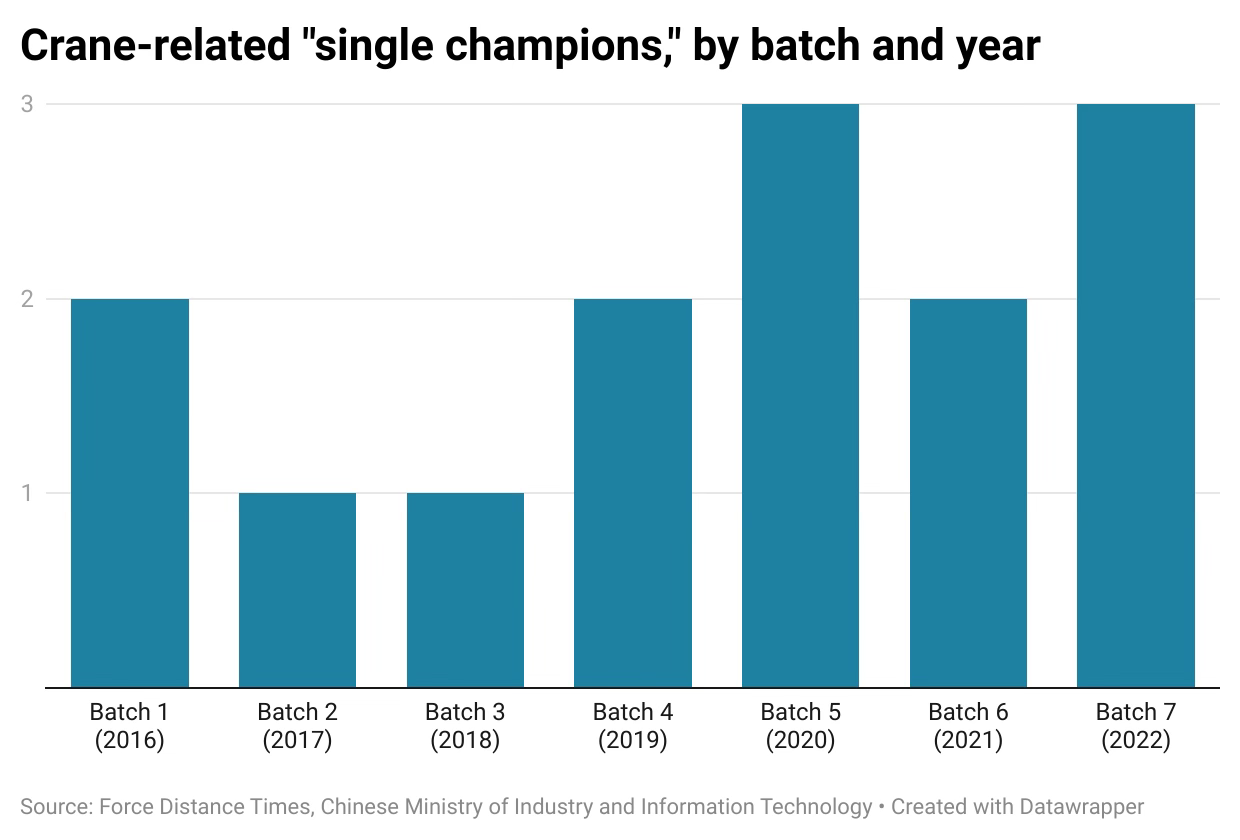

The ZPMC threat did not materialize overnight. Back in 2018, the company had already been designated a “single champion”—companies selected and supported by the Chinese government for their leading position in critical industrial nodes. As of 2022, there were more than a dozen Chinese companies selected as “single champions” for their dominance in cranes used in different industries.

Any US attempt to shore up critical infrastructure security as it relates to cranes must also contend with this wider roster of Chinese crane champions—or risk being blindsided, à la Huawei’s surprise comeback following premature obituaries of the tech giant.

Single champions, multiple competitors

“Single champions” is an industrial program run by China’s Ministry of Industry and Information Security (MIIT); we covered it extensively in a Force Distance Times research report published last year.1

Since 2016, MIIT has selected 1,300 “single champions”2—each typically ranked top 3 in global market share for their respective segments—and plies them with preferential policies to cement their positions of strength.

Our dataset of these companies shows that besides ZPMC, there are at least 13 other “single champions” with considerable dominance in the international industry for cranes:

While only ZPMC is singled out for its ship-to-shore crane prowess, several other companies in the table above build cranes for ports.

Weihua Group, for example, makes cranes for power plants and shipbuilding, but also cargo cranes like those ZPMC specializes in. Zhuzhou Tianqiao Crane also makes port cranes, and has a subsidiary that aims to be “a leading domestic and international container lifting machinery repair service provider.”3

The upshot of all this is that there are multiple moving targets that the US must monitor and address to remedy national security risks stemming from China-made cranes, both on home shores and beyond.

Intelligent logistics: a new competitive field

A brief note on logistics to wrap up.

Logistics plays a key role in geopolitical competition. China understands this: its international LOGINK platform for logistics data and communication gives it direct insight on, and the ability to shape, commercial transactions and trade flows.

The rise of intelligent logistics presents another vector along which the contest for global influence will play out.

For its part, China sees intelligent logistics as an emerging field in which new technologies like automation and industrial IoT can rejig prevailing competitive balances and enable upstart players to leapfrog incumbents. (Notably, China has an official definition of “intelligent logistics;” the US, as far as I can tell, does not.)

In October, the China Port Association published the country’s first ever company-designed technology standard to regulate 5G fixed network (F5G) technology that enbables remote control of container cranes. This F5G industrial network is already deployed at major ports including in Shanghai, Ningbo, and Tianjin, and promises to turbocharge efficiency at ports.

None other than Huawei is charging ahead as a major provider of F5G networks at ports. “The now-proven technology will soon make its way around the world,” Huawei noted last May.

That portends even greater integration of Chinese technologies into global supply chains—and in less visible ways than hulking cranes.

Weekly Links Round-Up

🖇️ Germany starts to question its separation of civilian and military research. With the global tech race in full swing, science minister Bettina Stark-Watzinger wants the country to rethink the “very strong wall” between the two types of R&D. (Science|Business)

🖇️ K-pop, K-drama, and K-defense. Thanks to persistent threats from its neighbor up north, South Korea already has a robust defense manufacturing base. Now it wants to boost arms exports and close the revenue gap with its competitors in other major economies. (Nikkei Asia)

🖇️ Should upstream inputs qualify for CHIPS Act tax breaks? Yes, says Hemlock Semiconductor, the largest American producer of high-purity silicon used to make chips. Not so sure, says the rules governing the legislation’s rollout. (Politico)

🖇️ Why isn’t the west stockpiling minerals while prices crash? China frequently does it, most recently snapping up excess cobalt to boost state reserves. Traders and executives say western governments should do the same. “We need to use national defense stockpiling like we do the petroleum reserve,”

of Dei Gratia Minerals tells Bloomberg. (via Mining.com)The Wall Street Journal also wrote about the report.

MIIT is expected to publish its eight batch of “single champions” later this year. We’ll be looking closely for signals of emerging points of asymmetric industrial leverage, crane-related and otherwise.

Yingkuntai (Shanghai) Port Equipment Engineering Co., Ltd. [英坤泰(上海)港口设备工程有限公司]; see Zhuzhou Tianqiao’s 2022 annual report

Right, espionage by harbour cranes, of course.

We already know which ship carries what cargo from where to where, where the ship currently is and what is the direction it is sailing. We know everything about the cargo, what it is, where and when it was loaded with what - and later where and when it was discharged.

What surprise element would anyone expect from a crane reporting home, that cargo has actually been loaded or discharged from a ship? Has everyone gone nutters?

Remotely enabling/disabling port equipment: If you connect your crane to the internet for unknown reasons, a gifted script-kiddie can do that.