China’s global rare earths shopping spree

Shenghe Resources snaps up strategic assets in Canada and Tanzania, and gains still more leverage over global rare earth supply chains

Welcome to a/symmetric, published by Force Distance Times.

Each week, we bring you news and analysis on the global industrial contest, where production is power and competition is (often) asymmetric. (Ahead of the holidays, this week’s dispatch comes a day early.)

This week:

A Chinese rare earths giant snaps up strategic assets in Canada and Tanzania—and further complicates efforts to develop ex-China rare earth supply chains

Weekly Links Round-Up: more rare earth news, China’s solar industry, Japanese M&A

China’s global rare earths shopping spree

China’s global rare earths giant, Shenghe Resources, is once again snapping up strategic assets around the globe. This time, it has its sights set on Canada and Tanzania.

At a time when China is increasingly dependent on imports of rare earth raw materials, Shenghe’s acquisition of strategic mine assets helps ensure a supply of upstream inputs with which to feed its operations further downstream—and in turn cement its dominance across the full rare earth supply chain.

“With rare earth prices falling from highs, industry companies are accelerating the strategic layout of overseas resources,” notes China’s Securities Times.

Shaky vital signs at Vital Metals

This week, Shenghe acquired a 9.99% stake in Australia-listed Vital Metals, a rare earths miner developing the Nechalacho mine in northwest Canada and a project in southern Tanzania. Shenghe has the option of raising its ownership further to 18.2%, totaling 14.8 million AUD (10 million USD) in share purchases. Naturally, Canadian politicians are concerned.

Vital certainly could do with the cash infusion. Facing a financing crunch, it had already paused all construction at its half-finished rare earths processing plant. By September, the processing subsidiary had gone belly up. A month later, Shenghe swooped in to throw Vital a lifeline.

Here’s what else Shenghe gets out of its “cornerstone investment” in Vital:

Vital will sell its “stockpiled rare earth material” from the Nechalacho mine to Shenghe. So much for Vital’s earlier claim that “[Nechalacho] is the only rare earths mine in North America that doesn’t supply China.” Plus, Shenghe gets to nominate one person to Vital’s board.

Shenghe will also acquire a 50% stake—and potentially up to 75%— in Vital’s Wigu Hill rare earth mining project in Tanzania.

The acquisition of Vital “will help further consolidate the company's development foundation and optimize the company's global business layout,” says Shenghe.

“State-led, enterprise driven:” a textbook case

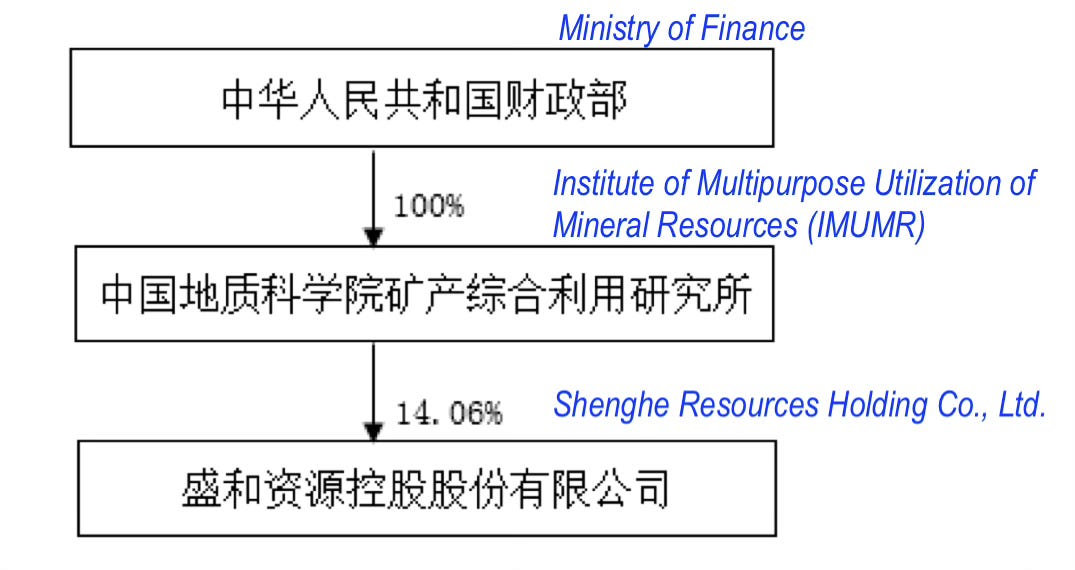

Shenghe describes its ownership as “mixed.” That’s partially true at best.

As the company discloses in its annual reports, its largest ultimate shareholder is the Ministry of Finance. More accurately, Shenghe is state-owned. But it has the blessing of the central government to roam worldwide, signing business deals and acquiring strategic assets to embed itself in key nodes of global rare earth supply chains.

Under this “state-led, enterprise driven” model, Shenghe has expanded it global footprint to include:

A 7.7% stake in US-listed MP Materials—which in turn depends on the Chinese firm for over 92% of its revenues, according to MP’s latest quarterly report

A 19.9% stake (and a board seat) in Australia-listed Peak Rare Earths, and an offtake agreement to buy all of the rare earths concentrate from Peak’s Ngualla project in Tanzania.

A 9.9% stake in Australia’s privately-held WIM Resource, a miner of rare earths-containing mineral sands. Another Chinese-registered company holds 28% in WIM, per company filings.

Assets in Canada and Tanzania, leverage worldwide

With the Vital acquisition, Shenghe now has access to rare earths from two projects in Tanzania: Vital’s Wigu Hill mine, and Peak’s Ngualla project.

But the additional leverage Shenghe gains goes far beyond these two physical assets.

Consider the fact that an effort to build a new Canada-Sweden-Norway rare earth supply chain takes rare earth carbonate from Vital Metals, and ship them to Norway for processing by REEtec. The aim was to reduce reliance on China. But Shenghe’s stake in Vital now puts China squarely back into the equation.

Meanwhile, Peak had plans to develop a rare earth refining facility in northeast United Kingdom—with the potential of making the UK a major supplier of neodymium-praseodymium oxide, used for rare earth permanent magnets. But that UK project was put on hold in August 2022, only six months after Shenghe agreed to buy a big stake in Peak.

As with MP, it seems likely that Shenghe’s offtake agreement to buy all of Peak’s output in Ngualla would see that rare earth concentrate shipped to China for processing there—in turn feeding China’s downstream rare earths supply chain and solidifying the country’s rare earth dominance.

Shenghe got its hands on mine assets in Canada and Tanzania this week. But more importantly, it won greater leverage to shape global rare earth supply chains and deepen global dependence on China.

Weekly Links Round-Up

🖇️ How big a deal is the news of China banning exports of rare earth processing technology? Reuters jumped the gun a bit, with its initial report suggesting that China had outright banned all technology to extract and separate rare earths. It subsequently made significant corrections, noting that one ban (on technology to extract and separate rare earths) was already in place.

In any case, none of this is particularly new news: the Chinese Ministry of Commerce had floated the rules in December 2022. The Rare Earth Observer cuts through the noise with a timely piece explaining what we should and shouldn’t fuss about. (Reuters, The Rare Earth Observer)

🖇️ China’s solar industry faces lacklustre exports. That’s despite China gaining an ever greater cost advantage, with its solar production costs falling 42% last year. Meanwhile, Turkey recently launched an anti-circumvention probe into Chinese solar panels, Brazil is resuming import taxes on photovoltaics and wind turbines, the EU is also considering tariffs, and the US is mulling higher levies.

One Chinese news outlet described China’s solar industry as being “hunted” on four sides even as the domestic market struggles with overcapacity and overseas demand is tepid. The chairman of Chinese PV giant Trina Solar says China must invest in battery storage systems if it wants to “break the market ceiling.” (Wood Mackenzie, WSJ, Shanghai Securities News )

🖇️ The start of a Japanese M&A wave? Nippon Steel’s surprise 14.9 billion USD takeover of US Steel to create the world’s third largest steelmaker could see more Japanese companies scouring global markets. And the weak yen could be both a push and pull factor for Japanese outbound dealmaking: while purchases could look expensive in yen terms, companies may also be desperate for a non-yen revenue stream. (FT)