China's AI industrial chain

China is currently dependent on high-end AI chips. But there are other gauges of relative strengths and weaknesses.

This week:

How resilient are different countries’ AI industrial chains? Import dependence is only one measure of countries’ relative strengths and weaknesses in AI.

Weekly Links: GPS backup plan, the EV tire industry, and Estonia’s drone makers.

China's AI industrial chain

Artificial intelligence demands computing power. Computing power requires powerful chips. And right now, China is pulling out all the stops to maintain access to advanced, foreign AI chips.

Consider the case of the Chinese student in Singapore who smuggled advanced Nvidia chips into China by bubble wrapping and stuffing them into his suitcase, as recounted by the Wall Street Journal’s story this week on an “underground network” circumventing US export controls.

Meanwhile, Huawei is investing heavily in its own Ascend 910B AI chip. But it’s facing challenges, including reportedly high defect rates. Chinese outlets picked up on the reporting, noting that the dismal 20% yield would potentially “have a chain reaction on major domestic technology companies such as Tencent and Baidu.”

And as The Information reported last week, US chip export restrictions “are beginning to squeeze [China’s] AI industry” — as judged by usage limits imposed by Chinese tech firms and AI startups like Moonshot AI and Alibaba Cloud.

Certainly, these stories underline China’s reliance on foreign technology required to fuel its AI progress. But, while important, import dependence is only one measure of countries’ relative strengths and weaknesses in the AI domain.

Let’s take a look at some other measures to round out the picture.

Assessing the resilience of the Chinese AI industry

We get an informative snapshot of how China assesses the security of its AI industrial chain from recent work published by Hui Wei, a researcher at the Institute of Industrial Economics of the Chinese Academy of Social Sciences.

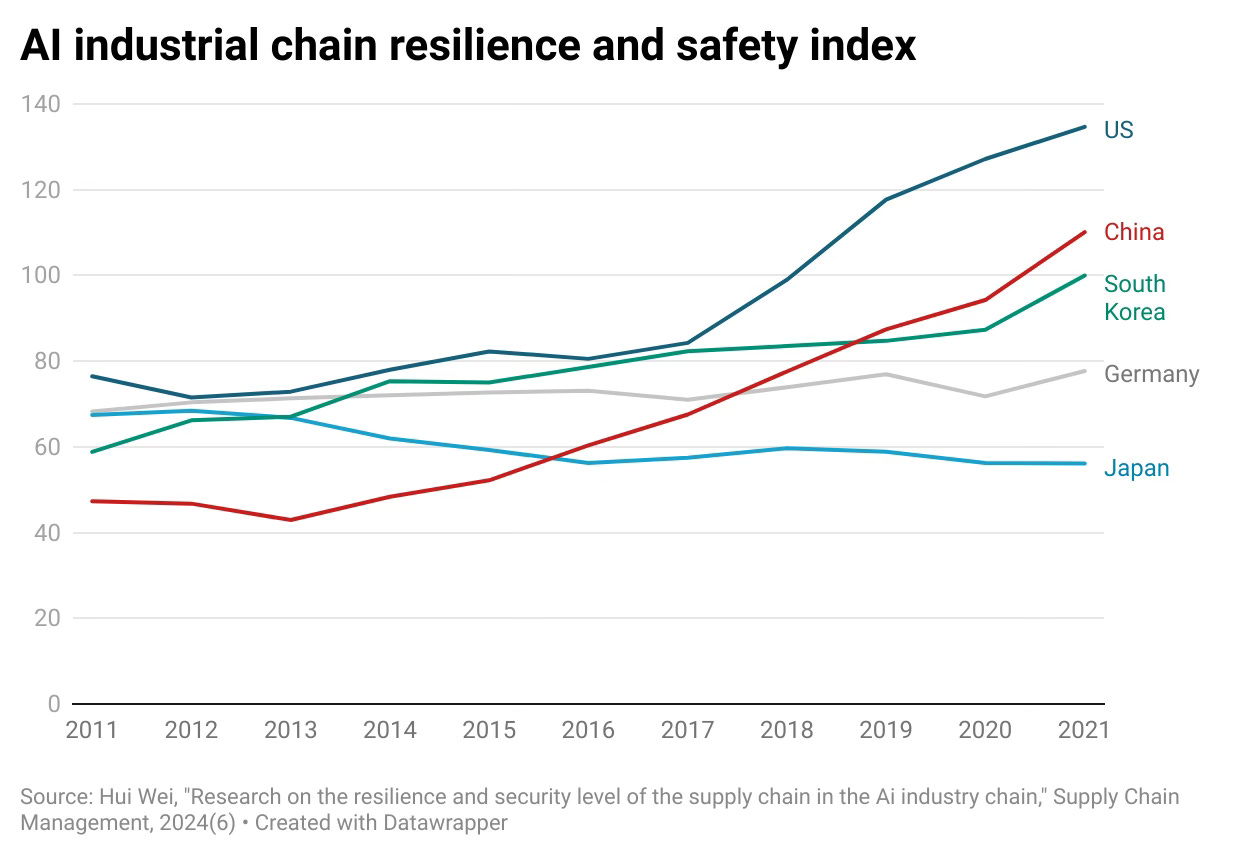

Hui created an index to measure the safety and resilience of different countries’ AI industrial chains. Her calculations put the US in the global lead, with China quickly catching up and surpassing incumbents including Japan, Germany, and South Korea.

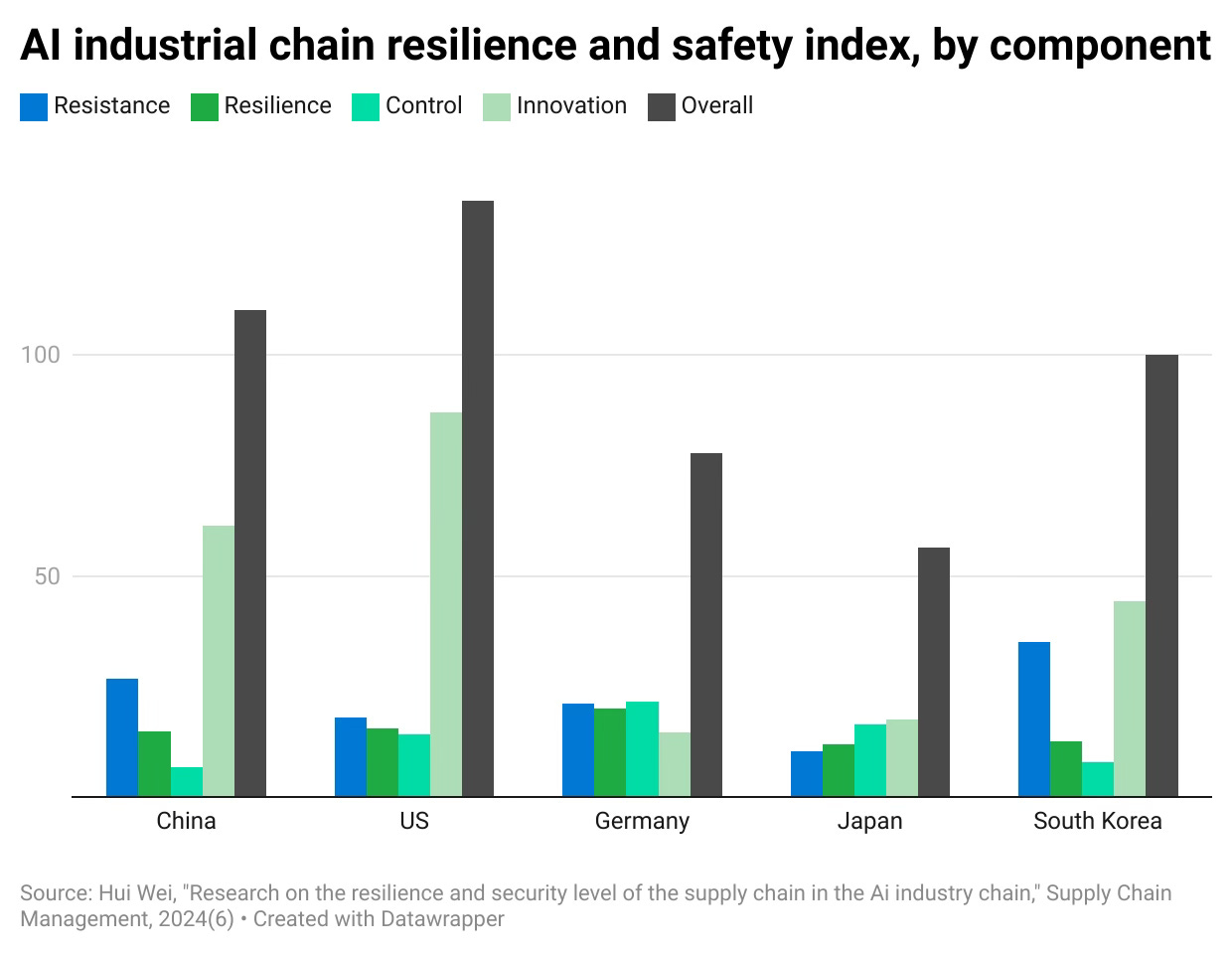

Looking at the index’s four major subcomponents — resistance, resilience, control, and innovation — gives us a more detailed view where China is currently most vulnerable in the AI domain, and where it might gain asymmetric advantages.

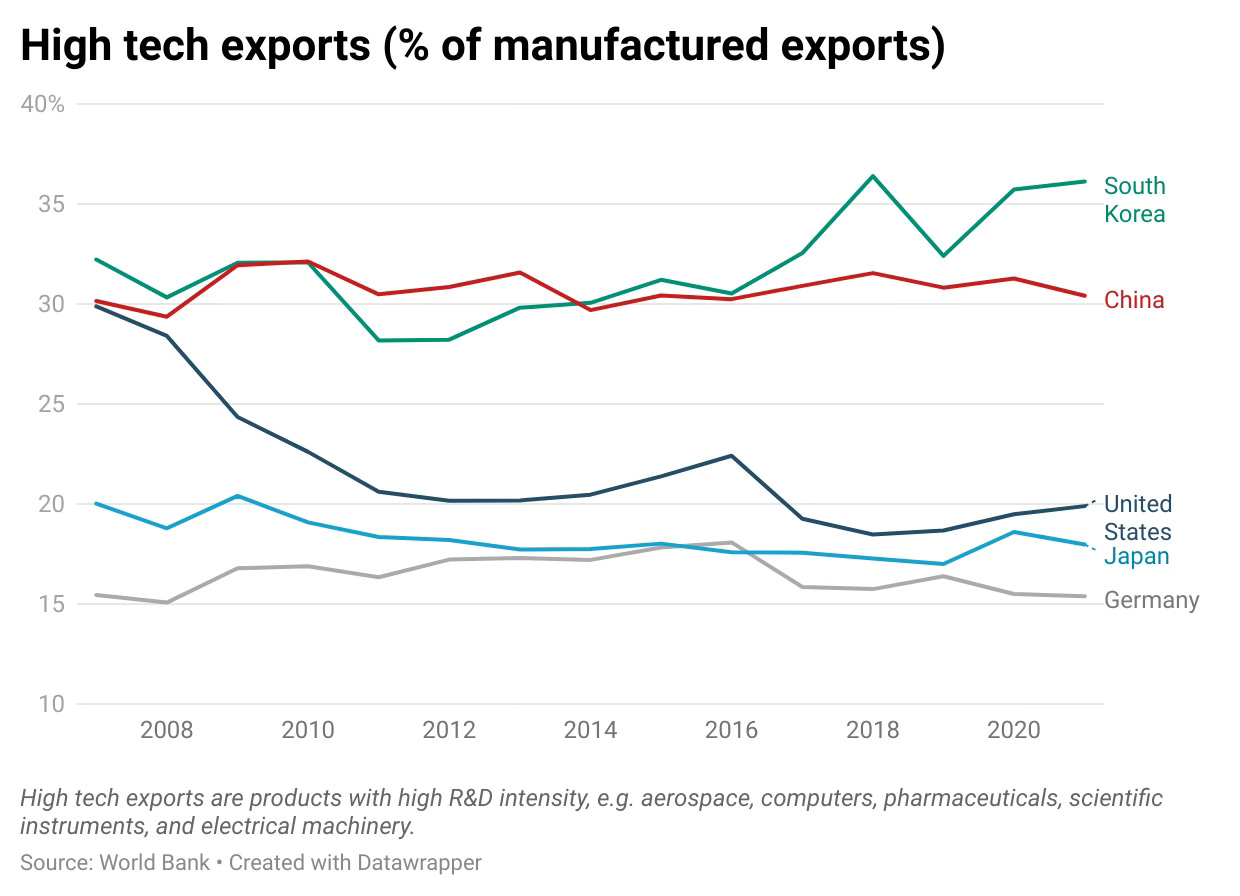

Notably, among the five countries Hui assesses, China ranks lowest in control over its AI industrial chain. To measure control, she looked at a country’s dependence on foreign chips; its high tech products as a share of manufactured exports; and the ratio of expenditure on to income from intellectual property royalties.

“China’s AI patents are mostly concentrated in the industrial chain’s mid- and downstream application layer,” she writes. “Even though Huawei’s Kirin 9000S chip achieved technical breakthroughs, it will take time for China to independently create chips, break through technological blockades, and solve the bottleneck dilemma.”

She also notes that the overwhelming majority of US AI-related patents are held by the likes of IBM, Intel, Microsoft, and Google. By contrast, most of China’s AI patents are held by universities and research institutions — exposing a rift between China’s theoretical research in AI and commercial and industrial progress.

China fares better in the “resistance” component, ranking second versus America’s fourth place. Hui measures resistance, or ability of a given country’s AI industrial chain to resist external shocks, by looking at two factors: imports of computers and telecommunications equipment as a share of overall imports; and national deployment of industrial robots.

Scanning the full competitive landscape

One takeaway from Hui’s research may be that while the most salient crimp on China’s AI capabilities appears to be its foreign chip dependence, the country has multiple other avenues for shoring up its AI industrial chain.

That includes investing in industrial AI to complement its existing manufacturing dominance, and building out “AI factories” and playing to China’s strengths in rolling out infrastructure at scale.

In other words, China’s struggle to procure enough advanced chips is only one part of the story — and may mask other ways in which the country is amassing strategic advantages in the AI domain. That has implications for how other countries compete in this emerging and rapidly shifting field.

Related reading:

Weekly Links

🖇️ What happens when GPS satellites are jammed and spoofed? A backup plan is needed. China has one; the US does not. The former “is building timing stations that broadcast signals covering the whole country and is laying 12,000 miles of fiber-optic cables that can provide time and navigation without satellites.” By contrast, “a US plan was proposed a decade ago but never took off.” (NYT)

🖇️ Wheeling and dealing. Tires on an electric vehicle wear out up to 30% faster than they would on a conventional car thanks to weight, torque, and lack of coasting (i.e., rolling freely), according to one engineer’s estimate. Now, leading tire makers Goodyear, Bridgestone, and Michelin are rolling out wires specifically designed for EVs. Chinese competitors are eager for a piece of the tire action: as of end-2023, there were at least 18 tire factories built by Chinese tiremakers worldwide, according to brokerage Pacific Securities. (C&EN)

🖇️ Estonian drone companies are learning battlefield lessons. Tallinn-headquartered drone makers Milrem and Krattworks have been providing Ukraine with drones—and iterating very quickly in response to frontline demands. They are also looking to replace made-in-China components thanks to Beijing’s tacit support for Moscow. (Defense One)

Other than our usual media boasting and startup hype, I've seen no evidence that China is behind us in AI. Their researchers dominate the field and they're a decade ahead of us where it matters: in commercial and industrial application of the technology, with no sign that US chip export restrictions “are beginning to squeeze [China’s] AI industry”. Huawei's 'reportedly high defect rates' is speculation by one Korean journalist.