Asymmetries in the US-China tech contest

Who will best leverage them? And who will get outflanked and outplayed?

This week:

Competing for the technological frontier: Our new research report assesses how the US and China are competing in tech. The piece below highlights key themes.

Weekly Links: An ammo factory in Texas. Can China overtake on undersea cables? Plus: Chinese autonomous driving startups seek IPOs.

Asymmetries in the US-China tech contest

Force Distance Times has published a new research report benchmarking the US-China energy contest. Our piece this week highlights some key themes. Read the full report here.

The US and China are locked in a technology competition. That much is clear.

Less well understood is how each side assesses the contours of that contest, and the strategies for winning it. Yet any serious game plan must contend with the opponent’s view of the competitive landscape—or risk of being outflanked and outplayed.

Right now, prevailing English-language coverage and analysis of the US-China tech competition typically reflects, consciously or otherwise, several broad assumptions. Those assumptions are not necessarily wrong. But they do raise the question of whether transposing a US-centric analytical framework onto the Chinese technological ecosystem might create blind spots, strategic vulnerabilities, and lost opportunities.

One such assumption is that the US-China contest plays out in discrete domains, with clearly delineated battlefronts. This framing, however, belies the whole-of-industrial-chain approach that China takes to the tech competition, where each technology (e.g., drones or EVs) exist not in isolation but are deeply embedded in the wider industrial ecosystem — and over which China seeks to increase control.

Another assumption is the US and China share the same set of metrics for assessing their relative competitive balances. While much attention is paid to the battle for supremacy over cutting-edge technologies, receiving comparatively less focus are domains — like international technical standards and “new infrastructures” — that typically aren’t prioritized in US competitive strategy, but that China views as ways to gain strategic advantages.

Benchmarking the competition

At core, the assumptions outlined above reflect an under-appreciation of asymmetries inherent in the US-China competition. One way to account for those asymmetries is to benchmark the US and China’s standings across key areas of science and technology (S&T).

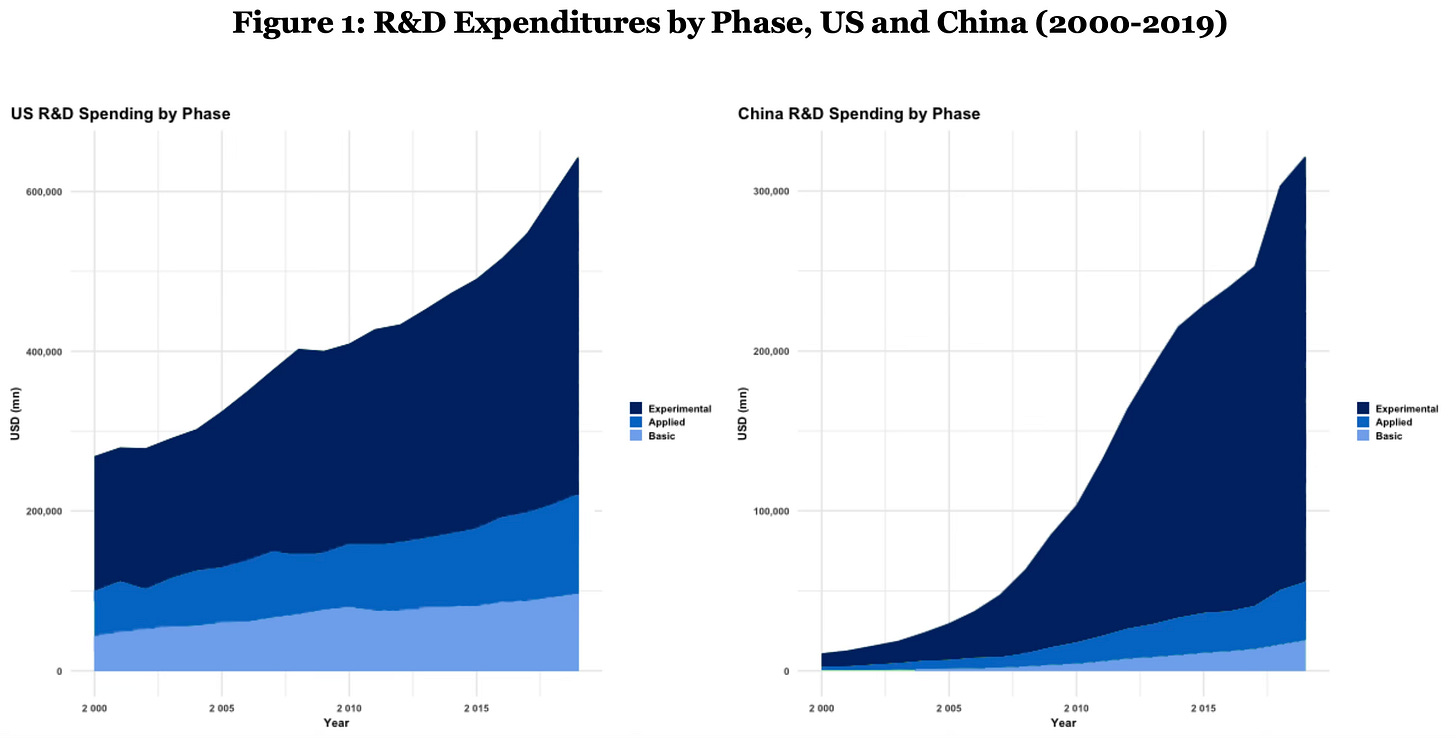

Take research funding, a key input for S&T capacity. In absolute terms, US spends significantly more on R&D than China. Breaking down R&D spending by phase reveals a more complex picture. The US has historically invested more heavily in basic research than China. By comparison, China spends a greater relative share of resources on applied and, especially, experimental science and technology.

This asymmetry in types of R&D spending suggests that the two players diverge on how to develop emerging S&T fields and competitive advantage within them. Specifically, China sees fast deployment of applied technology as a critical factor in the global industrial contest, in some cases leading to greater strategic payoffs than if it had primarily focused on basic research.

If research spending is a key resource for S&T development, then infrastructures are key to applying emerging S&T capacity at scale. Since 2018, China has emphasized a set of “new infrastructure” including 5G base stations, ultra-high voltage networks, and high-speed rail and urban rail.

Electric vehicle infrastructure is another example: China has invested heavily in building EV public charging stations, numbers of which currently far exceed those of the US. Still another emerging example is infrastructure for drones and low-flying aircraft: while Washington mulls banning a single Chinese drone maker, DJI, China is positioning itself across key nodes of an entire “low altitude economy.”

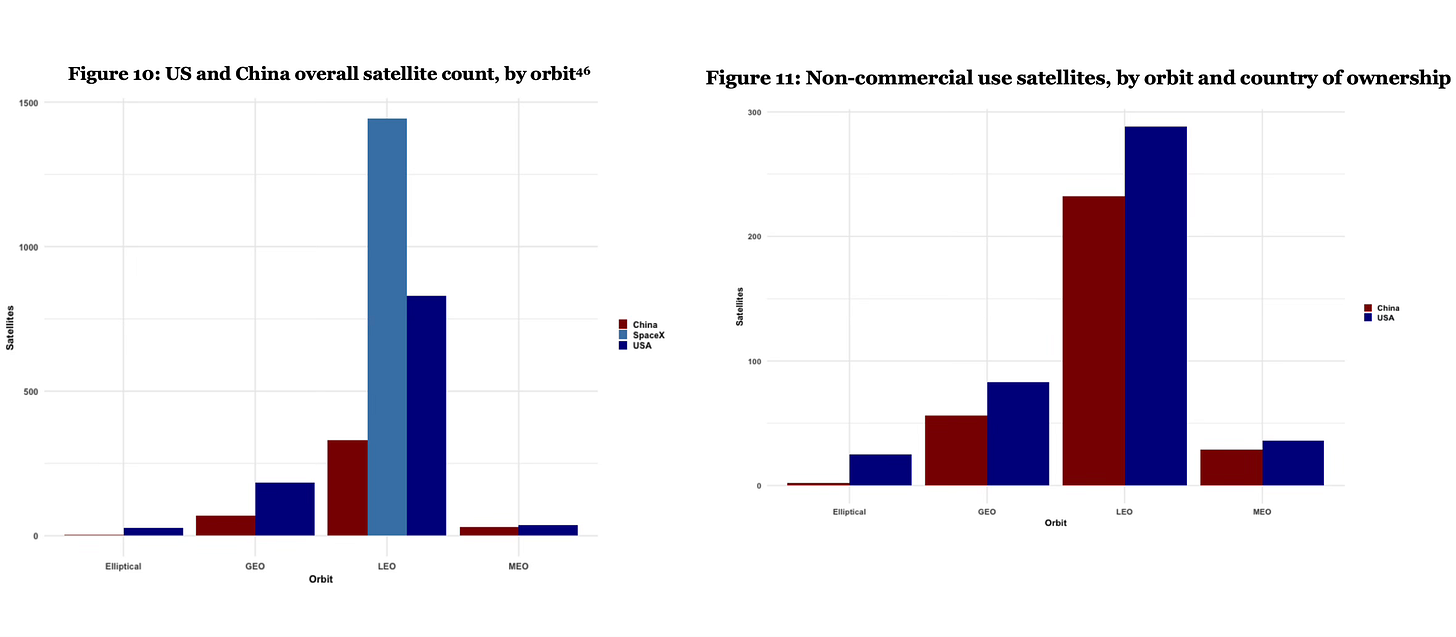

Or consider satellites. Even though the US boasts a quantitate advantage over China in the satellites it owns or operates across types of orbit, the respective countries’ government- and military-owned satellites sit at relative parity. An upshot of this observation is a potential asymmetry of control: Chinese government control over its satellite ecosystem is considerably more centralized compared to the fragmented US playing field. And that’s not to mention the China dependencies of American satellite services.

Then there are technical standards, which influence how infrastructures and technological domains take shape, and the commercial hierarchy within them. National or commercial players with the ability to shape standards can then determine how a corresponding technology develops, in turn granting them competitive advantage in relevant commercialization.

A closer look at China’s representation in international standards setting bodies bears this out. While there are more US members in the International Telecommunications Union (ITU), a United Nations agency that sets rules for global telecom and tech infrastructure, China holds more leadership positions within the ITU’s sectors and sub-groups. This potentially gives Beijing outsize influence in the ITU, especially as the Chinese delegation has far deeper government ties than does the US delegation.

The technology contest is an industrial contest

Perhaps the most critical asymmetry of all is China’s approach to the technology competition as a fundamentally industrial one.

“The essence of competition among major countries is scientific and technological competition,” professor Wang Yu of the Nanjing University Business School wrote in the state-run People’s Journal in March. “And scientific and technological competition must take industrial competition as the core realization method.”

China has long understood this. The US, after decades of outsourcing manufacturing and hollowing out its industrial base, is only slowly coming around to this realization.

Weekly Links

🖇️ The Texas factory that’s a key ammo supplier for the US and Ukraine. “The push to quickly expand domestic manufacturing will rely heavily on foreign countries,” reports Doug Cameron. Ideally, that reliance wouldn’t be on a rival. But as the story notes, the robots that enable the largely automated process of making artillery shells at the General Dynamics plant are made by Chinese-owned robotics firm Kuka (which we wrote about recently). (WSJ)

🖇️ China wants to be a dominant player in subsea cable. “The US’s undersea network is its tool to keep its hegemony,” an executive at leading Chinese fiber optic cable maker FiberHome says in an interview. “The subsea cable industry is like a membership club, we all need other governments’ consent to link with their countries…This is a diplomatic race.”

Another insightful quote comes from Antonia Hmaidi of Merics: “Subsea cables are pretty well-established technologies. It’s not like advanced semiconductors, which are changing and becoming much more advanced every year…[In the In the subsea cable market,] Chinese companies were able to become big just by being able to integrate better.” (Nikkei Asia)

🖇️ Chinese autonomous driving firms are rushing go public. “Autonomous driving is a money-burning business…In order to relieve the pressure on funds, a number of Chinese autonomous driving industry chain companies have chosen to sprint for an IPO.” (Caijing, link in Chinese)

Thank you!

One quibble: China will spend 2.6% of its $35 trillion GDP ($0.9 trillion) on R&D this year and the USA will spend 0.8% of its $26 trillion GDP ($200 billion) on R&D.

Stats support this discrepancy, too. China is far ahead in almost every aspect of STEM research, development and implementation.